One crucial aspect you need to master in Cities Skylines 2 is taxation. In this game, there are four types of taxes: residential, commercial, industrial, and office taxes. But be careful, increasing taxes can have a significant impact on your city’s economy and overall happiness. Whether you’re a seasoned player or just starting out, this information will help you create a thriving city. So, let’s dive in and discover the secrets of taxation in Cities Skylines 2!

Introduction to taxes

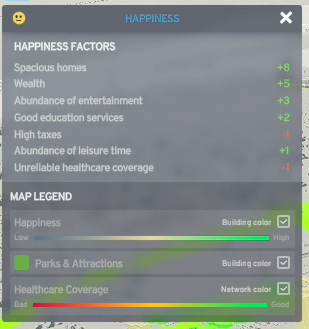

In Cities Skylines 2, taxation is an important aspect of managing your city’s economy. There are four types of taxes: residential, commercial, industrial, and office taxes. Increasing residential taxes can generate more income but may decrease overall happiness. It is advised to avoid increasing residential taxes too much, especially for lower-income households which should have problems to paying rents after that.

Commercial and industrial taxes can be increased by a fair amount before affecting business profitability. Office taxes should be adjusted using the main tax slider rather than individual rates. The impact of taxes on happiness and income is significant, so finding the right balance is crucial. Gradually increasing taxes and considering the education levels of citizens can help attract higher-paying jobs.

How change taxation in Cities Skylines 2

To adjust taxes in Cities Skylines 2, follow these steps:

- Click on the Economy button and go to the Taxation tab.

- Adjust the tax rates for Residential, Commercial, Industrial, and Office zones.

- Increase taxes gradually and consider the impact on overall happiness.

- Monitor the City Statistics to track your finances and make adjustments as needed.

Okay levels of taxes

Residential taxes seems okay under 14% while you have this level then you see that happiness of resident’s is -1 by taxes. So taxes around 11 – 12% seems better for your residents. Probably your resident’s could live with much higher taxes until they start leaving the city co if you have problems then you should increase taxes.

Raised taxes = less happines

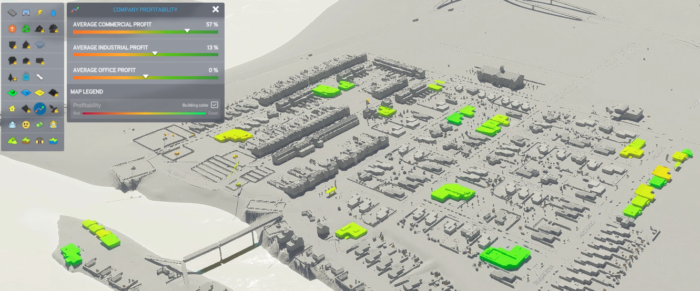

Commercial taxes depends on profitability if you doesn’t have problems with not enough customers and you see profitability which I had on image above then you should be ok with taxes around 15 – 19% from commercial as long as they’re comfortable with it. If you build not healthy economy then you need to lower taxes here.

Industrial zones and offices I don’t discover much yet. But I think that this will work same as commercial taxes if they have higher profitability then will be okay to pay higher taxes than is normal.

What is great that you should focus on specific business in your city so you should adjust taxes only on oil / petrochemicals and other taxes for industry have on normal levels. I would only do this if I have a surplus of a given raw material and am exporting it. I suppose I make more profit. Is important think about profitability and taxes when we talk about industry / companies. If in some of sectors you have deficits then you should boost production by lovering taxes.

More articles about economy and money in CS2

How to make a lot of money in Cities Skylines 2

How work taxes in CS2 and why you need to increase them

Solving problem with not enough customers in CS2

How to earn money by export/import power in Cities Skylines 2?